ESG reporting is an increasingly important consideration for small- and medium-sized enterprises (SMEs) looking to demonstrate their sustainability commitments. Tracking and reporting ESG effectively can be a complex task, here we offer a concise guide on how best to approach this.

Why SMEs should care about ESG reporting

SMEs are critical to economies in transition and those who demonstrate their sustainability commitments can enhance their attractiveness and reputation among business partners and customers.

Getting started can be difficult. That’s why choosing the right framework for your business is key. There are several to choose from depending on your needs, but they’re all designed to help you effectively identify and report on the ESG issues closest to your business and stakeholders.

A big part of your ESG reporting will focus on carbon emissions. Knowing how to measure this effectively across your business operations is critically important – both for advancing your own sustainability commitments as well as engaging meaningfully with your customer base.

After understanding the “why” of ESG reporting for SMEs, the rest of this article will focus on the “how”, offering a summary of guidance for setting yourself up for success in this area.

How to approach ESG reporting

1. Goal setting

Understanding ESG standards – Sustainability reporting enables businesses to provide stakeholders with consolidated answers to a wide range of questions about their ESG risks and opportunities. However, they must meet the requirements of their chosen reporting methodology, which makes it important to identify a standard that best suits your business.

Below are a few of the leading ESG standards commonly used in Hong Kong, which will help you define your reporting boundaries:

- GRI standards

- SASB standards

- TCFD framework

- Hong Kong Stock Exchange (HKEx) ESG Reporting Guide

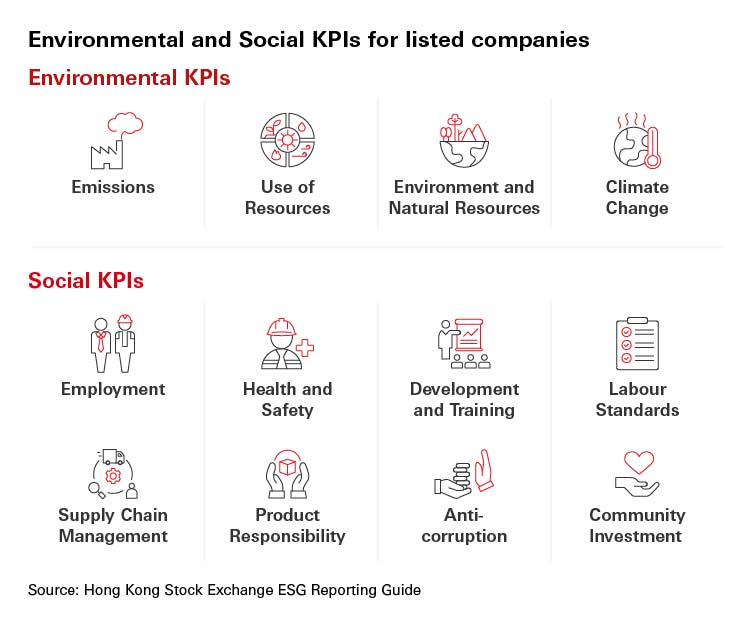

According to the HKEx ESG Reporting Guide, there are basic areas that should be covered in a sustainability report:

Benchmarking – Once you’ve chosen a reporting standard, the next step is to start benchmarking your company performance and collecting data. This will involve identifying your priorities. Apart from getting top management buy-in, you will need to engage your internal and external stakeholders to achieve consensus on what sustainability means to your business. This will help you then link your ESG KPIs to your business goals and risk factors, ensuring that your sustainability report comes across as strategic and relevant to your audience.

Setting ESG KPIs – From environmental aspects such as energy consumption, water consumption and waste to social aspects including employee turnover, health and safety, development and training opportunities and a set of clear and trackable KPIs need to be put in place. These are to reflect your ESG priorities and will be the key progress areas to highlight in your communications.

2. Mapping the ESG reporting journey

After identifying ESG KPIs, SMEs should consider four key areas as they begin the reporting process: people, data sources, stakeholders and persistence.

People – Putting together the right team to support your ESG reporting is essential. Think about your range of ESG KPIs and how these relate to your business units. Engage with each team and collect data for the KPI most relevant to the team.

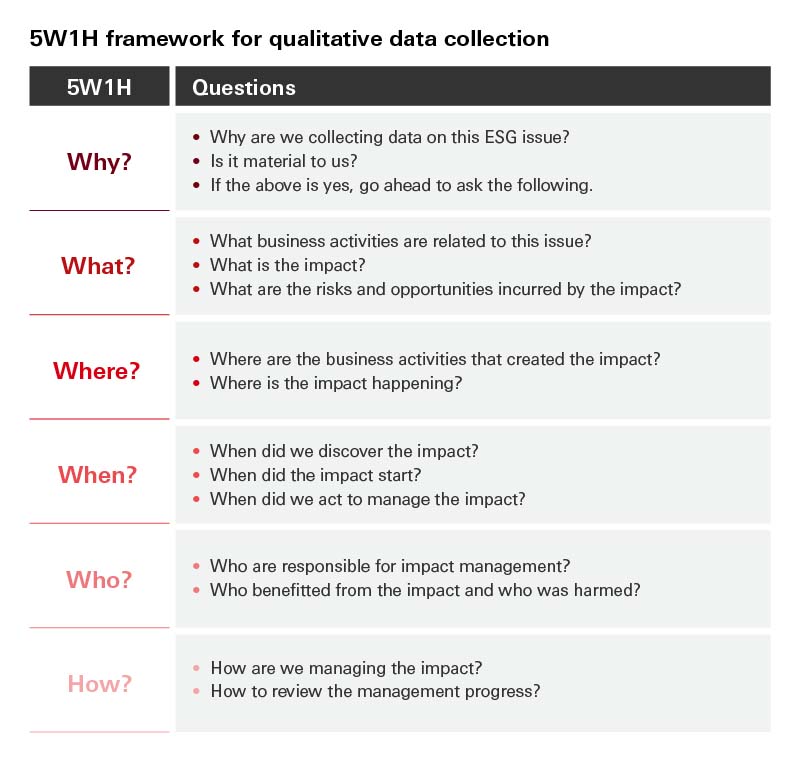

Data sources – There are two types of data in ESG reporting: quantitative and qualitative. Quantitative data is numerical and directly related to your KPIs. Qualitative data is more observational and experience-based; the below core set of questions can help you acquire the information needed.

After collecting your data, it’s important to review, organise and analyse it for purposes of report compilation. Digital ESG reporting tools such as diginex, which uses blockchain and machine learning technologies in its software, can be a big help by automating parts of this process and streamlining the production of reports at the end of the year.

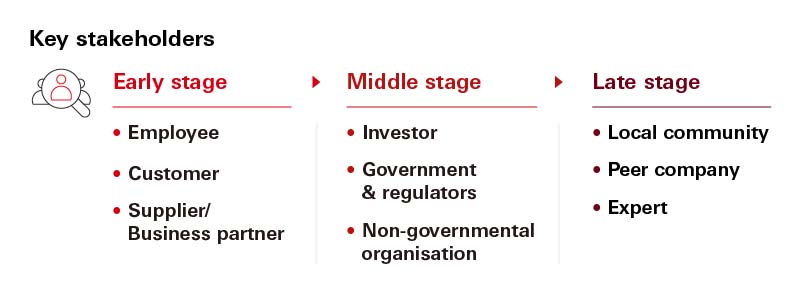

Stakeholders – When determining the materiality of a given ESG aspect, it’s important to consider the impact both internally on your business and externally on your stakeholders. You may adopt a widely used method, called a “materiality assessment”, to gauge stakeholders’ needs and identify where you want your business to be in the future.

Below is an overview of the types of stakeholders that may be relevant to your business:

Persistence – Establishing a realistic and sustainable cadence for collecting data is key to effective annual ESG reporting. Consistency in this will not only help you keep a pulse on your KPI progress, but also make it easier to bring all your data together when the time comes to report.

Preparing for the future

Looking ahead, the imperative around ESG reporting and demonstrating transparent progress against your sustainability commitments is only going to grow. Which is why it’s important to begin thinking about and preparing for this today. SMEs that take proactive steps in this critical area can unlock significant value and strategic advantages, as well as enhance their resilience as they prepare for the future.

Disclaimer

Today HSBC finances a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.