Today, Environmental, Social, and Governance (ESG) risks and opportunities are increasingly recognised by consumers, investors and regulators around the world. This drives demand for ESG data when analysing a company’s performance or making financial decisions.

Against this backdrop, many companies are looking for ways to link business initiatives with ESG performance, but locating a suitable framework capable of managing this is easier said than done.

What does materiality assessment mean to you?

At present, ESG reporting is voluntary for most companies in the majority of markets globally, but increasingly stock exchanges have started to include sustainability as part of their listing requirements as well as firms choosing to start reporting on these metrics.

In Hong Kong, a listed company is currently mandated to publish an annual ESG report. These reporting demands are expected to be further strengthened by 2025.

To compile these important documents for clients, regulators and investors, companies need to identify ESG issues that are most significant to their business or stakeholders, an exercise called “materiality assessment”.

During these assessments, companies can systematically map out the ESG issues that can have significant impacts (either positively or negatively) on their companies, a process designed to help prioritise ESG objectives and incentives.

Some companies may go further in their assessments, looking to identify “financially material” and “impact material” issues as well. The former refers to factors that may build up or erode enterprise value, while the latter concerns effects on people, the economy and the environment.

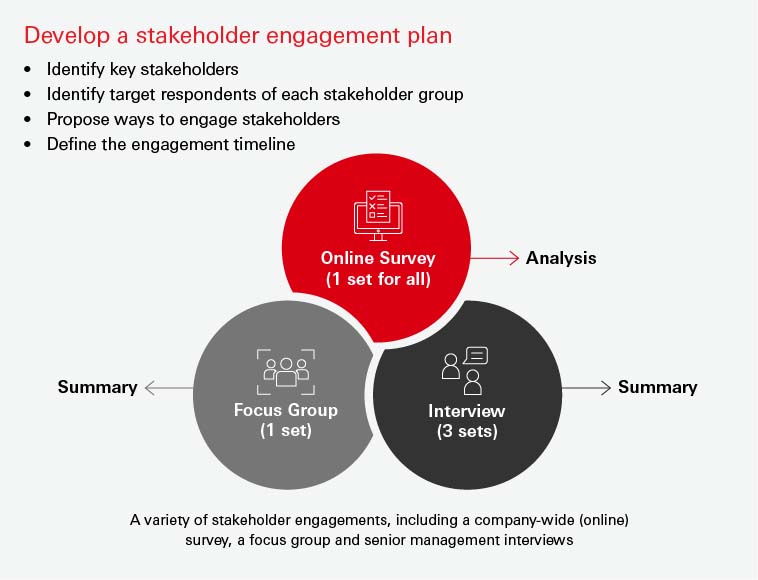

To effectively identify material considerations, ESG champions of these companies may pursue a variety of stakeholder engagements, including company-wide (online) surveys, focus groups and senior management interviews.

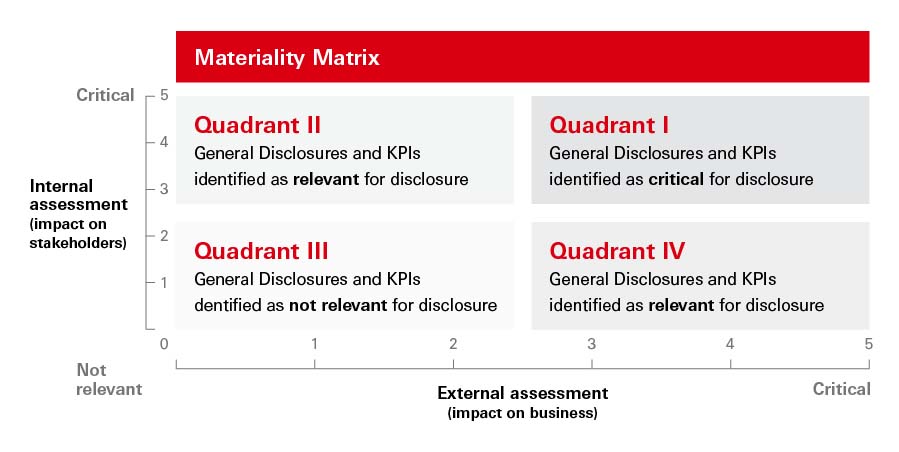

These inputs can then be weighted and plotted on an ESG Materiality Assessment Matrix according to their relative degrees of importance. This matrix – a graphically presented outcome of the surveys – can then be reviewed by company leaders and various ESG groups and committees to set priorities. This method is widely endorsed by ESG specialists, rating agencies and is also recommended by Hong Kong Stock Exchange in its ESG reporting guide.

An example of an ESG Materiality Matrix – General Disclosures, KPIs and ESG factors that are placed within Quadrant I of the materiality matrix are considered critical for disclosure in the ESG report because they are highly material. ESG factors that have a high position on one axis but a lower position on the other axis (i.e. Quadrant II and Quadrant IV) may also be considered material. Source: How to prepare an ESG report, Hong Kong Stock Exchange

Which reporting framework should you follow?

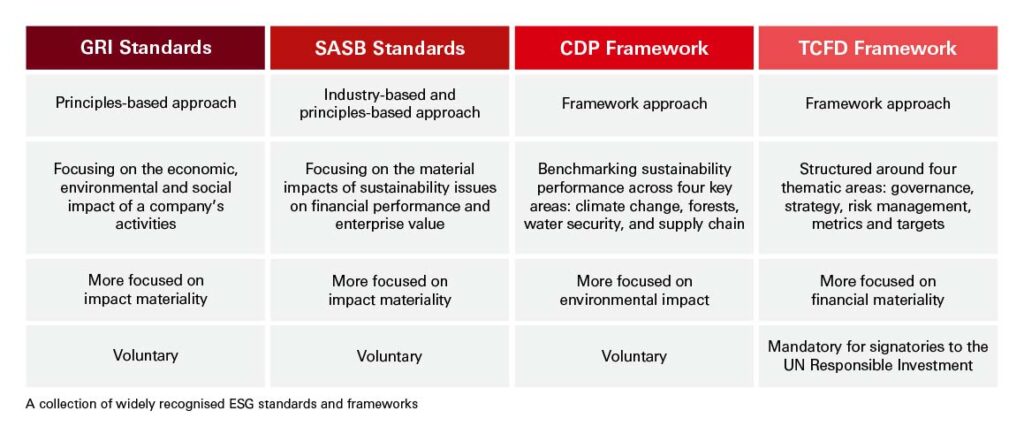

There are a few globally-recognised ESG frameworks available, GRI and SASB standards are most widely used:

- GRI Standards

The most widely used reporting standard and endorsed by United Nations Sustainable Development Goals (SDGs). GRI adopts a principles-based approach, focusing on the economic, environmental and social impact of a company’s activities. It is suitable for any organisation – large or small, private or public. - SASB Standards

Short for Sustainability Accounting Standards Board. SASB adopts an industry-based approach and focuses on which sustainability issues are likely to have material impact on the financial performance and long-term value of companies. According to Value Reporting Foundation, more than half of the S&P Global 1200 companies use SASB for disclosure. - CDP Framework

Carbon Disclosure Project (CDP) is an investor-led NGO that runs a global disclosure system for investors, companies, city and state governments, and other regional institutions to manage their environmental impacts. It also offers a specific framework for small- and medium-sized enterprises (SMEs). - TCFD Framework

Short for Task Force on Climate-related Financial Disclosures, an international workgroup created in 2015. TCFD is a principles-based framework for climate-related financial disclosures. Hong Kong is anticipated to mandate all TCFD recommendations by 2025 which will further standardise its ESG reporting requirements.

The European Sustainability Reporting Standards (ESRS) coming effective from 2024 for certain types of companies operating in the European Union will further change the ESG reporting landscape.

These burgeoning sets of referencing tools are set to enable more organisations, no matter large or small, to put sustainability to work and respond to their stakeholders’ needs.

Disclaimer

Today HSBC finances a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.