Extreme weather events like droughts and wildfires have become increasingly common and have highlighted the need for solutions to address climate risks. Separately, we continue to see corporations whose business and reputation are damaged for dubious application of their social responsibilities, while others thrive in part because of their positive relationship with consumers and stakeholders. The logic is plain to see. How a company impacts the Environment, broader Society, and approaches its Governance around this – also known as ESG practices – can be material to a company’s prospects and value.

A study by Deloitte last year demonstrated that companies which manage their ESG risks better benefit from higher valuations. The study also found that companies which materially improve their ESG practices benefit even more, with valuations increasing at faster rates than their ESG scores. For example, a 10-point improvement (on a scale of 100) in ESG score nearly doubled the enterprise value to earnings ratio1.

Likewise, our research has also identified a clear performance benefit from ESG momentum, or improvement in ESG scores, at the broader portfolio level. Specifically, looking back over more than a decade of data, we found that tilting allocations towards equity markets with greater ESG momentum at any given point in time would have delivered steady outperformance across the period.

Understanding ESG ratings in investment portfolios

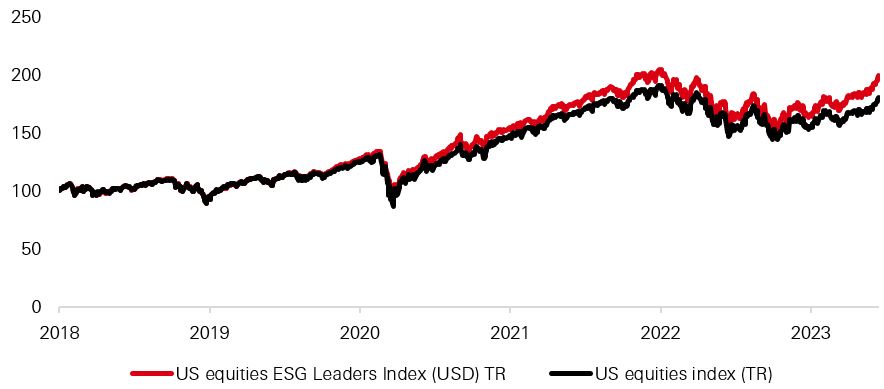

Ratings from data providers are the best means for investors to capture material ESG considerations. Scores can be considered a holistic summary of ESG performance that is linked to the financial and operational risk of a company. Aggregated to the portfolio level, scores provide an indication of exposure to companies with better or weaker ESG practices. The chart below reflects how increasing exposure to ESG leaders has generated improved performance over time. While this is also true going back over longer time periods than shown below, there have also been periods of underperformance in certain years.

US equities ESG leaders have outperformed the standard index

Typically, ESG scores include multiple pillars and themes that are deemed as key issues relating to the environmental, social and governance categories. For example, MSCI ESG ratings integrate themes like climate change, natural capital, and pollution and waste into the environmental pillar, and human capital and product liability in the social pillar. As environmental and social risks are industry-specific, the methodology of ESG scores goes a step further by focusing on material issues for relevant sectors. Data governance and privacy, for instance, are more relevant to the IT and internet sectors, while labour relations are more relevant to labour-intensive sectors. Governance themes, such as corporate governance and behaviour, are universal issues applicable to all industries. Data points and theme scores are aggregated based on materiality weighting to produce a top score.

Integrating top-level ESG scores, such as the MSCI ESG rating, is a common approach to monitor ESG risks at a portfolio level. A portfolio weighted average ESG score provides a holistic summary of your portfolio’s ESG attributes and can be compared with benchmarks to better navigate potential risk exposures. We consider additional factors, such as ESG improvement within companies and regions, alongside overall ESG scores, to inform investment decisions and further enhance portfolios.

Enhancing ESG considerations in investment decisions

Every company will be impacted by climate change or societal challenges at different times and to a different extent. Investors should take steps to protect portfolios from the financial risks caused by these ESG related issues. While monitoring a portfolio’s ESG performance is a good starting point to consider ESG and sustainability risks, it’s important to consider potential differences in methodology by different ESG rating vendors. Furthermore, more tools and metrics can be used to help investors better understand their portfolio’s performance on particular sustainability issues, such as carbon emissions. The availability of these metrics can help investors identify sustainability-related risks and align their investment objectives with their sustainability preferences.

1Deloitte – ‘Does a company’s ESG score have a measurable impact on its market value?’, 2022. Earnings measurement used is Earnings Before Interest, Taxes, Debt & Amortisation (EBITDA)