Addressing Environmental, Social and Governance (ESG) practices as part of business strategy has been growing in importance in recent years. The ‘why’ is no longer a subject of debate – it’s now all about the ‘how’, as SMEs prioritise trying to implement meaningful strategies.

What is ESG?

A set of specific, measurable Environmental, Social and Governance criteria that investors can use to analyse and evaluate a company’s performance and the associated risks and growth opportunities in investments.

Did you know?

The term ‘ESG’ was coined in 2004 when Kofi Annan, former UN Secretary General, invited 23 major financial institutions to participate in a joint initiative to better integrate ESG into capital markets.

ESG vs sustainability

Sustainability is a blanket term for a company’s ability to create long-term value by building a well-rounded sustainable business model. The focus is on making positive impacts by meeting environmental needs, social needs (i.e. of employees, consumers, other stakeholders and the community), and the economic needs of the business itself.

ESG is a specific set of metrics with key performance indicators that are used to assess and quantify a company’s exposure to a range of environmental, social and governance risks.

Did you know?

In 1987, the United Nations Brundtland Commission defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

Why should SMEs care?

Market regulators (e.g. HKEX) require companies to disclose their ESG-related information. Investors are increasingly deploying ESG criteria as part of their screening process.

Most environmental impacts occur in the upstream supply chain; SMEs are crucial for building a transition economy. Customers are concerned about enterprises’ environmental and social impacts. Therefore, SMEs that demonstrate strong ESG commitments can enhance their corporate reputation, build brand loyalty and trust, and attract capital or financing.

Did you know?

Over 70% of Asian investors have paid more attention to environmental and social issues since last year, indicating the growing

momentum behind sustainable economic change in the region.

Source:

HSBC Sustainable Financing and Investing Survey 2021 Asia Report

How can SMEs operationalise ESG?

Simplifying the supply chain

- Build resilience in the supply chain through regional sourcing or nearshoring

- Digitalise production to facilitate demand-driven business models

- Enhance productivity, efficiency and supply chain transparency

Streamlining the product portfolio

- Condense the product matrix

- Reduce the volume of raw materials used

- Increase the use of sustainable materials or embed circularity

Minimising the carbon footprint

- Understand your company’s carbon footprint

- Focus on corporate climate actions, measuring Scope 3 emissions, energy efficiency and conservation

- Understand the carbon footprint of your products

- Focus on new technologies, innovations and using fewer raw materials

Improving data integrity

- Adopt an online carbon management platform

- Embed an international reporting framework and an ESG assessment

- Use auditable sustainability data

Embracing social responsibility

- Develop responsible sourcing policies and carry out due diligence on the supply chain

- Develop corporate governance practices and risk management structures in areas such as anti-bribery, anti-corruption and human rights

- Participate in key initiatives that address the social challenges of an industry or country

How can you approach any ESG communications?

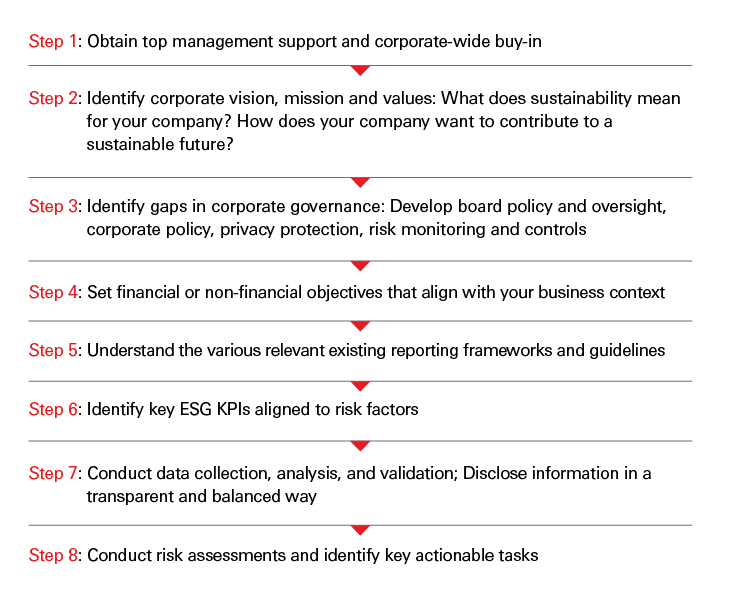

Effectively reporting on your ESG activity and strategy is essential for informing all manner of stakeholders whether they are clients, staff or investors. These steps can ensure valuable and worthwhile ESG reporting:

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.